Hat Trick Letter – duben 2011

Jsou na tom USA jako Řecko? – Is US Economy In the Similar Situation As Greece?

THE USECONOMY IS AT HIGH RISK OF A GREEK STYLE FINANCIALCOLLAPSE, DESPITE ALL THE ADVANTAGES OF CONTROLLING THE GLOBALRESERVE CURRENCY AND ITS MONETARY SPIGOT. AT THE ROOT OF THEPROBLEM IS MAMMOTH DEBT AND PHONY ACCOUNTING, THE HUGE GAP FORWHICH CREATES A RISK OF COLLAPSE FROM LOST CREDIBILITY AND INTEGRITY. THE USFED IS SOWING SEEDS OF INFLATION AND FOREIGNRESENTMENT. THE MORAL HAZARD OF BIG USBANK BAILOUTS HAS CAUSEDSEVERE RISK OF FURTHER FINANCIAL CRISIS. THE RESPONSE TO CRISIS HASRAISED THE RISK OF AMPLIFIED CRISIS.

Rob Arnott believes the United States is in great danger of a Greek style collapse. At Research Affiliates he manages $75 billion in assets. He gives an grave warning. He said, „I think the US is playing Russian roulette the same way the Greeks were. We are using phony accounting just as they were using phony accounting. The GAP accounting, if it was applied to the US government, would have shown our deficit in 2009 not at 10% of GDP, but at 18%. The 18% of GDP [is arrived at] if you factor in new unfunded social security and medicare obligations, if you factor in SEs, if you factor in the off-balance sheet spending that does not appear on the balance sheet. If you factor all of these in, we spent 18% more than w eproduced as a nation in 2009. Well, that is horrific. And so is it worse than Greece efore they hit the wall. Under correct accounting it is worse.

Bernanke has been on record as saying, ‚LOOK, THE STOCK MARKET IS UP, PEOPLE ARE OUT SPENDING, AND THEREFORE THIS IS WORKING.‘ What he adamantly denies is that it ripples blond stocks. But it is ridiculous that the cascading effect would stop at the convenient point of equities before it reaches the inconvenient point of commodities. Of course it is affecting commodity prices all over the world, and of course that is creating some geopolitice instability. So is the Fed sewing seeds of dissension in parts of the world where the consumption basket is mostly commodities? Yeah of course it is. The Fed will not acknowledge it but it is true. If too big to fail, [the big banks have been allowed to] roll the dice and play the moral hazard game of heads I win multi-billion dollar bonus pools, tails the taxpayer takes multi-hundred billion dollar hits. That is wrong. We looking at a situation where we have allowed moral hazard to create a financial crisis and the response to that financial crisis is to allow the moral hazard issues to become more severe than ever. So I do view the current situation as fraught with a certain measure of risk.“

USGOVT DEBT IS AT A TIPPING POINT. UNLIKELY DEBT REPAYMENT, ESCALATING DEBT LEVEL, AND GROWING INSOLVENCY ARE GREAT THREATS. URGES HAVE COME FOR THE USFED TO HALT ITS DEBT MONETIZATION AND MONETARY AGGREGATE GROWTH SPIGOT. WARNINGS COME FROM INSIDE THE USFED ITSELF, HARDLY A COHESIVE BAND IN DEFENSE OF A FORTRESS.

USFED MONETIZATION WILL CONTINUE. THE QE2 WILL GRADUALLY BECOME MELDED WITHIN THEIR REGULAR MONETARY POLICY. THE FOUR BIGGEST DOMESTIC REASONS FOR CONSTANT QUANTITATIVE EASING ARE 1) ABSENCE OF USTREAUSURY BOND BUYERS, 2) THE GARGANTUAN USGOVT DEFICITS, 3) THE WRECKED HOUSING MARKET, AND 4) THE BLOAT OF PROPERTY RELATED TOXIC ASSETS ON THE BANK BOOKS. THEN ADD ON THE FOREIGN POLICY IN OPPOSITION TO THE CANCEROUS PROPAGATION FROM THE USFED. AS EVIDENCE OF THE CANCER, NOTICE THE MARGINAL BENEFIT OF NEW DEBT. IT IS LONG PAST SATURATION, WHERE PRICE INFLATION HAS NO MORE RESISTANCE.

Inflace v USA se začíná projevovat. – US Inflation Arrived.

PRICE INFLATION HAS ALREADY ARRIVED IN THE USECONOMY. THE WAL-MART EXECUTIVES AND THEIR FOLLOWERS ARE WELL AWARE. NOTICE THEY ARE NOT FEATURED ON THE NEWS NETWORKS MUCH. PRICE INFLATION IS COMING FROM SEVERAL CORNERS (MATERIALS, SUPPLIERS, SHIPPING, AND FOREIGN EXPORTERS) TO THE USECONOMY. THE MAJOR RETAIL CHAIN IS THE FLAGSHIP, THE CANARY, THE BILLBOARD.

Wal-Mart is an accurate gauge of the USEconomy, since it is so large and dominant as a detail chain, the world’s biggest. CEO Bill Simon expects price inflation, serious inflation in his works, in the months ahead for clothing, food, and other products. Despite being in a better position than competitors to minimize the price effects, still Simon expects price inflation to be serious. He said, „We are seeing cost increases starting to come through at a pretty rapid rate. We are in a position to use scale to hold prices lower longer, even in an inflationary environment. We will have the lowest prices in the market.“ Some prices were increased as the company paid for costly store renovations. The major chain is famous for low prices. When their price structure rises, then all retailers will have raised theirs too. The modest price inflation figures promoted by the USGovt propagandists and Wall Street shills will turn upward, even after their usual gimmicks to soften through adjustments. The Wal-Mart business incorporates the cost effects from numerous factors, as suppliers must deal with higher input material costs. Foreign vendors export their finished products, largely from 160 Chinese manufacturing plants owned entirely by Wal-Mart. The higher shipping costs are built in also, passed along.

USA zvedají limit pojištění vkladů na nekonečno. Co je za tím? – Why FDIC Set No Limit For Insured Accouts?

THE F.D.I.C. BANK DEPOSIT INSURER HAS RAISED THE LIMIT ON INSURED ACCOUNTS TO AN UNLIMITED AMOUNT. THE RULE CHANGE LAST DECEMBER MIGHT SIGNAL A LARGE BANK GOING BUST SOON. THE RELAXED RULE MEANS THE DEPOSIT INSURANCE BENEFIT WILL BE GIVEN ACROSS THE BOARD WITHOUT THE TIME CONSUMING DECISIONS TO BE MADE. EXPECT BIG BANK RUNS, FOR WHICH THE F.D.I.C. WILL BE READY.

An important notice took place at the end of 2010. The Federal Deposit Insurance Corp might have just signaled an intention to go into high volume production and processing of dead banks. The new rule, no limit on the size of deposit insured, means no decisions must be made in hat could become a heavy volume task. And with each dead bank whose assets must be processed, the job will be much simpler. From 31 December 2010 through 31 December 2012, all non-interest bearing transaction accounts are to be fully insured, regardless of the balance of the account and the ownership capacity of the funds. This coverage is available to all depositors, including consumers, businesses, and government entities. The unlimited coverage is totally removed from the insurance coverage provided for a other accounts held at an FDIC-insured bank.

Technically, a non-interest bearing transaction account is a deposit account where a) interest is neither accrued nor paid, or b) depositors are permitted to make an unlimited number of transfers and withdrawals, or c) the bank does not reserve the right to require advance notice of an intended withdrawal. Neither Money Market Deposit Accounts (MMDAs) nor Negotiable Order of Withdrawal (NOW) accounts are eligible for this temporary unlimited insurance coverage, regardless of the interest rate, even if no interest is paid. The FDIC will be sugar daddy to all non-interest bearing accounts regardless of the size of the balance. It seems the problem is the lack of organization and staff at the FDIC needed to take over a bank with over $10 billion in deposits. They typically must complete the liquidation work over a weekend, in a minimal disruption directive. When the bank is very large, they do not have enough time for the due diligence, before making decisions on the depositors one at a time. One might infer that the FDIC thinks it will need to take over larger banks, and this policy change facilitates the process. Another line of thought points to extremely large depositor accounts by the power elite, who have demanded full insurance. The challenge comes from the reverse gear to the fractional banking. The banks owe $1 million to depositors for every $100k held in reserve assets. The new FDIC rule could be in anticipation of bank runs, in addition to big bank collapses. Expect some powerful magnificent bank events, maybe bank runs soon.

Konce petrodolarového standardu se blíží – The Days of the Petro-Dollar Are Coming To an End

THE SAUDIS ARE MAKING INTERNAL PREPARATIONS FOR LIFE BEYOND THE AMERICAN SECURITY BLANKET. THE FLIP SIDE IMPLICATION IS THAT THE PETRO-DOLLAR DEFACTO STANDARD IS ABOUT TO LOSE ITS GLUE. A WEDGE IS GRADUALLY BEING DRIVEN BETWEEN THE UNITED STATES AND SAUDI ARABIA. THE USDOLLAR CANNOT SURVIVE WITHOUT GLOBAL CRUDE OIL SALES AS A COMMODITY STAPLE BEING SOLD IN EXCLUSIVE USDOLLAR TERMS. IT IS THAT SIMPLE. REMOVE IT, AND THE USDOLLAR HOUSE FALLS.

Before a crowd in the United Arab Emirates, Saudi Prince Turki al-Faisal stressed that the Gulf states must look after their own security after recent events in the Middle East and North Africa. A new major rift has opened with the Saudis. The breach has had clear markings from the USGovt support, both direct and tacit, for major populist Arab upheavals from Egypt to Libya to Yemen. The Saudi monarchy has a long track record in strong opposition to democratic reforms. It is a basic dictatorship in white robes that gives it citizens zero rights while the royals take 95% of the natural wealth.

One must consider the potential for highly disruptive and motivated hidden agendas on the part of the United States. The US might have an agenda for a higher oil price, which would bring higher Saudi and OPEC revenues from from which to purchase USTreasury Bonds during a time of massive unmanageable USGovt deficits. Also, the US might have an agenda for helping along unified Moslem democracies in order to form a bigger rival in new cold war. The stronger rival would assure consistent and growing military budgets for the Pentagon, always eager for a very cold war. Whatever the motive, whatever the conflict, the great risk is for the unraveling of the USGovt protective blanket given to the Saudi royal family. If it is removed, then the flip side is for the removal of the understood US$ pricing of OPEC crude oil. If crude oil and other commodities are no longer sold in US$ terms, then the USEconomy will be forced to adapt to a 30% to 50% lower USDollar valuation, and corresponding higher commodity prices. That consequence is not obvious to most economists, since they take the PetroDollar standard for granted. The Jackass does not, ever since the Russians and Chinese announced with Saudis and Japanese joined at the hip, that by year 2016 the crude oil would no longer be sold in USDollars. They made the announcement in May 2009.

The days of the Petro-Dollar are coming to an end. The USDollar devaluation in the FOREX market would be immediate. The implication to the USEconomy is hyper price inflation. The next destination is the Third World. Imagine the USDollar bidding for another currency in which to buy commodities, then finished products from China. Then imagine a USDollar worth 30% 50% less. Then consider the impact on the USEconomy that would assure an inflationary recession turned depression fast, like in a New York minute!!

Přežije dolar? – Will USD Survive?

THE USDOLLAR CANNOT SURVIVE THE CRISIS. BUYING TIME SOLVES NOTHING, AS IT ONLY EXACERBATES THE PRICE INFLATION SCOURGE. PRESERVING THE BIG USBANKS REQUIRES HUGE CONTINUOUS PAYMENTS FROM THE NEW MONEY SPIGOT. THE WORLD IS PREPARING FOR THE DAY WHEN THE USDOLLAR DOES NOT DICTATE THEIR FATE. SINCE CHINA

PROVIDES MOST FINISHED PRODUCTS, A YUAN CURRENCY HELD IN RESERVE MAKES SENSE. THE BIRTH OF CHINESE YUAN IN BANKING RESERVE SYSTEMS IS SOON TO EMERGE.

Ending QE2 ending would cause a certain rise (maybe a spike) in interest rates, trigger a renewed banking crisis, and inevitably unleash a debt crisis that would lead to a global run on the USDollar. Unfortunately, the extension of more QE, like a QE3, will serve only to delay the inevitable and make conditions much worse in the end. Each new QE round guarantees a higher cost structure for the USEconomy and most of the world. My forecast is for global QE as the USFed conceals the QE within routine policy, going so far as to lie and claim it has ended and fulfilled its purpose. A formal new QE3 launch announcement, still a highly likely event, will probably be blamed on the Japanese natural disasters, as well as on Chinafor its withdrawal of USTBond purchases.

A NEW I.M.F. CURRENCY BASKET REPRESENTS THE FINAL DESPERATE ATTEMPT TO HOLD ONTO THE FIAT CURRENCY SYSTEM. IT IS PRICE FIXING, NOTHING MORE. THE MAJOR FIAT CURRENCYS WILL BE TIED TOGETHER, THUS ELIMINATING THEIR RELATIVE EXCHANGE RATES. THE END RESULT WILL BE EQUITABLE HYPER-INFLATION AS THE ENTIRE COST STRUCTURE WILL RISE UNIFORMLY VERSUS ALL THE DOMINANT GLOBAL CURRENCYS. ITS ONLY SUCCESS WILL BE A HALT TO THE USDOLLAR DECLINE VERSUS ITS COMPETITOR CURRENCYS. WITNESS THE ACTIVE AVOIDANCE OF A GOLD STANDARD.

EXPECT A NEW GLOBAL CURRENCY CHARADE. THE INTL MONETARY FUND PLAN IS JUST A REPACKAGED VERSION OF FIAT CURRENCIES. IT INVOLVED AN ATTEMPT TO FIX EXCHANGE RATES, AND THUS TO PREVENT A USDOLLAR COLLAPSE. INSTEAD THEY WILL EARN A COLLAPSE OF ALL MAJOR CURRENCIES IN UNISON, AS GOLD & SILVER RISE LIKE A PHOENIX.

USDOLLAR DECLINE WILL CONTINUE AND EVEN ACCELERATE. FACTORS RELATE TO THE MIDDLE EAST AND NORTH AFRICAN NATIONS, WHO FIND FAVOR IN THE EURO CURRENCY AS A TEMPORARY PORT FOR STUFFING RESERVES. THE EFFECT ON THE USDOLLAR IS BREAKDOWN BELOW SUPPORT FROM THE LAST TWO AND THREE YEARS. THE B.R.I.C. NATIONS HAVE THEIR OWN MOTIVE TO MOVE AWAY FROM THE USDOLLAR ON GLOBAL TRANSACTIONS. LED BY ASIA, CREDIT FACILITIES IN RESERVE ACCOUNTS WILL BE YUAN-BASED. THE DEVELOPING ECONOMIES ARE SHOCKED AT THE USDOLLAR DEBASEMENT.

Faros Trading provided a solid brief cogent piece of analysis on the USDollar’s extréme vulnerability. Its decline will continue, even accelerate. Some important points are Word noting in the details offered. They said, „For the past nine months Asian reserve managers have controlled the direction and to an extent the pace of USD weakness, whether valut in terms of the USD/Index or the EUR/USD. Three months ago they were joined by Latin American central banks, as they sold the USDollars that they were buying each day to keep their own currencies relatively weak on an export competitiveness basis. The Latin American and Asian central banks have been happy to work bids in the market, passively adding liquidity rather than taking it. They have done this by working bids below the market, relying on the market to come to them as peripheral fears, and interest rate differential changes result in bouts of USD strength. This passive strategy of USD selling has worked for some time, and the players have been content with the pace of the move and the liquidity they have been absorbing. The game has changed.

The Middle East has changed the game because they are forcing Asian reserve managers to question their passive strategy. If Asian central banks are passive, they miss buying the EUR/USD at 1.4040, because the Middle East is front-running their orders. This has caused a number of Asian reserve managers to raise their bids in the EUR/USD as the market rises. In effect, through frustration, Asian reserve managers are moving from set bids to rolling bids,.i.e. set a bid 50 pips below today’s high. This strategy could see faster moves to the topside in the EUR/USD in the months ahead. It could certainly steepen the slope.

We find it especially interesting that Brazil allowed the BRL [Brazilian Real currency] to strengthen to 1.6280 today, just as Brazilian and Chinese relations have recently warmed, specifically regarding the issue of the Yuan, but also given that President Rousseff’s first state visit will be to China on April 11th. We believe the only reason Brazil is allowing the BRL to strengthen is because they expect China will do the same going into the G-20 meeting on April 14th. Further CNY [Chinese Yuan currency] strength equates to further USD weakness. We continue to call for 1.5000 in the EUR/USD over the next 3 months. The game has changed.“

Jak jsou na tom evropské banky? – Situation of EU Banks

SPANISH AND IRISH BANKS ARE THE MOST VULNERABLE TO THE EURO CENTRAL BANK 25 BASIS POINT RATE HIKE. SPANISH HOME LOANS HAVE A HEAVY TILT TO ADJUSTABLE RATES. JOBLESS BENEFITS ARE COMING TO AN END. A CRISIS IN SPAIN IS OVERDUE. IT WILL HIT LIKE A HURRICANE IN EUROPE AS BANKS TOPPLE.

Spanish and Irish banks dependent upon the Euro Central Bank for liquidity could see thein profits squeezed as rising interests rates hike borrowing costs. To the point, Spain and Ireland have high proportion of floating rate mortgages.

GERMAN FINANCE MINISTER HAS URGED NO BAILOUTS OF THE BIG GERMAN BANKS. THE BATTLE IS ON TO CUT OFF THE BANKER WELFARE TO THE SOUTH, AND TO CUT IT OFF DOMESTICALLY. SOME SMALLER TEST CASES ARE ON THE DOCKET IMMINENTLY. DAMAGE WILL BE FELT ON BOTH ENDS, DEBTOR AND CREDITOR. A BIG NAME GERMAN BANK IS GOING TO FALL, AND SOON.

German Finance Minister Wolfgang Schaeuble has recommended that no German banks on the verge of collapse should expect bailout money from the German Govt. According to Reuters, two mainstream German lenders, Helaba and NordLB, could fail during the next round of more stringent European bank Stress Test. Some real stress could be actually put to the exercise, unlike the charade last time both in the US and Europe. The results are due in June. Schaeuble is resolute in his position. He said, „If the results of the tests show a need for fresh capital, the bank owners are there to cover these needs. It is not the case that one can appeal to the state. The funds of Soffin (German’s bank rescue fund) are not available for any new requests. It is no longer like in 2008 that there are no alternatives. We have an insolvency law.“ Schaeuble wants to require German savings banks and regional states with major stakes of ownership in the two lenders to prop up the banks, and therefore not turn to the German Govt fund for rescue. One can infer from a domestic bank aid policy so tight, that further German participation in more bailouts of the PIIGS sovereign debt is not to be tolerated. Both Helaba and NordLB are small banks. The real test is for larger and more influential banks need money, like DBank. The stage is set for some banks in Germany to falter, fail, and fall.

Přežije euro? – Will Euro Survive?

MERKEL HAS BEEN HUMILIATED BY MASSIVE DEFEATS IN A FEW GERMAN PROVINCES. IMPLICATIONS ARE HUGE. THE GERMAN PEOPLE ARE SICK & TIRED OF SUPPORTING THE BROKEN SOUTH WITH THEIR AMPLE SAVINGS. THE EASTERN ALLIANCE IS QUIETLY ASSUMING A VANTAGE POINT IN GEOPOLITICAL POSITION, ALTHOUGH HIDDEN TO DATE. BIG CHANGES ARE COMING TO EUROPE, THE FUSE LIT.

The seasoned experienced brilliant European contact with vast contacts on four continents pitched in with a valuable perspective. He is German and knows his nation well. Being trilingual (Russian language too), he is well versed with numerous global contacts. He responded to the humiliating Merkel defeats, which he predicted months ago. He wrote, „Germany is fleeced to the tune of 400 billion Euros per annum by the Club Med and other losers in Europe. The entitlement jockeys of Southern Europe are in for rude awakening. The Berlin, Moscow, and Beijing leaders are going to set the tone for regaining stability. The Anglo-American Axis has driven the entire financial and political system over the cliff. They will next attempt to stiff the rest of he world with their incredibly vacant proposals like the carbon tax and IMF currency, in order to retain their power and privilege. It is soon game over for the Boyz. Angela Merkel is the East German lackey, not stupid, a top notch scientist. People need to learn to produce again, even to produce a little bit more than they consume. It is called wealth creation. If someone has nightmares it should be Sarkozy, Cameron, and Obama, the three stooges. The upcoming blowback from the mounting ongoing financial crisis will be horrific. Things will never work out the way the US and British bankers plan in the coming months and years.“ The key is change, shift of power & control to the East, and unexpected turns in the ongoing crisis. It is called Paradigm Shift, a topic mentioned frequently in the Hat Trick Letter.

My response is finally to bring it on, bring justice, bring equitable power, to weaken the syndicate in power. My dream, unsure of its inevitable outcome, is to push the Anglo bankster off their perch. In the last year, the US & UK bankers are much more on the defensive, but hardly anywhere near losing their posts and privileges. Several potential important events could signal a significant change in their hold on power. It could be a significant move in Gold toward $1600, or silver past $60. It could be the Saudis openly discussing an end to the standard for crude oil sales in US$ terms. A blockbuster event in the COMEX could reveal they have no silver, and their gold supply is a queer Just-In-Time inventory from BIS swap midnight express shipments. One big US bank like Bank of America could go under, despite steady narcotics fund input. A G-20 Meeting could take place with open calls for a new non-IMF, non-US$ global reserve, and shock the Western bankers who are attempting to steer the direction toward an IMF basket of major currencies. It could be some nasty exposure of USMilitary involvement in popular uprisings, even the military assistance to natural disasters from the infamous HAARP weapon usage. In my opinion, the next highly disruptive events will come from Europe, like a huge bailout regest by Spain that is refused. The Euro Central Bank rate hike will have ripple effects, continued hikes to follow, and a deep impact on Southern European banks. The stage for change has been set, the fuse lit.

THE EURO CENTRAL BANK HIKED RATES TO 1.25% UPON GERMAN DIRECTION. THE SOUTHERN EUROPE BANKS WILL BE PRESSURED IN A VISE. GERMANY WANTS THE CRISIS TO BUILD, IN ORDER TO SPARK A SIGNIFICANT ENOUGH CRISIS TO SEPARATE FROM THE UNION AND ITS DEADLY OBLIGATIONS FOR CLUB MED WELFARE. CERTAIN BANKERS IN CONTROL WANT TO FORCE THE SITUATION IN EUROPE. EUROZONE PRICE INFLATION HAS INCREASED. IN REALITY THEIR C.P.I. IS AT LEAST TWICE THE OFFICIAL NUMBER. MY BELIEF IS THAT THE PRICE INFLATION CARD IS BEING USED BY THE EUROCB AND GERMAN BANKERS TO SEPARATE FROM THE RECKLESS USFED.

Simply stated, Germany is sick & tired of forfeiting $300 to $400 billion annually to support the Southern European nations, complete with broken banking systems, lethargic conomies, and a culture that is not consistent with that of the Germany powerhouse. They wish to halt the waste of money, like having a truant deviant lazy son. The monetary decision of a rate hike begins the process to cut off the PIGS nations by forcing bank stress. In mid-2008 the Jackass had an important disagreement with a well placed German banker who thought the Euro Central Bank would never lower interest rates to absurdly low levels like the Americans. My view was that the EuroCB would indeed follow the USFed, but in delayed fashion, after the Euro currency started to rise and threaten their export trade. It did precisely on cue, and the ECB hiked in quick time. They do not want to continue the insanity of ultra-low interest rates, since it is so destructive. Savers earn less. Commodities cost more. The Euro currency has responded to tighter monetary conditions by moving from 130 at the start of year 2011 to 145 this week. Central bank president Jean-Claude Trichetattached the rate decision to the risk of accelerating inflation, and added that rates were still very low. The Europeans want any credible reason to separate from the reckless American monetary stance stuck in the 0% corner. Notice the reference to Germans who wanted the hike long ago, not even in the first place. Trichet said unapologetically, „The hike is unwelcome for peripheral countries, but arguably the core member states were in need of this move already some time ago. In that sense, the timing of the increase is a balancing act, which is part and parcel of the one-size-fits-all monetary policy. We did not decide today that it was the first in a series of interest rate increases.“ He understands the impal to the Southern European nations, especially their banks, which are expected to be stressed by the decision. Basically, Germany has had enough, and wishes to force the situation, to topple Southern banks, and to proceed with the delayed climax. They want a restructure, and one will come.

The consensus interpretation is that the EuroCB is more concerned about inflation than slow growth. Trichet is well aware that 1.5% is still 5% to 7% too low for interest rates, and very aware that the type of price inflation encountered is deadly, on the cost side. Expect the Euro currency to continue rising. The true price inflation is obviously closer to 10% than 5%, surely not below 5% to any rational observer. Almost never does a single rate hike occur. The key point also that the Europeans are making distance from the Americans, often called insane on monetary management. The Europeans must follow the American lead often. The nasty rub, the Euro will rise until it causes pain in quick feedback felt by German exporters. Notice in the mainstream press that nobody mentions the Germans wishing to force the situation into a crisis, to enable change finally. They want debt restructure and to topple dead banks. The ripple effects will surely stress the dead US & UK banks.

A RATE HIKE COULD DOOM THE EURO CURRENCY, EVENTUALLY NOT IMMEDIATELY. THE NEXT PHASE COULD BE A FINAL BURST BEFORE A FULL SPUTTER. THE COMMODITY (FOOD & ENERGY) PRICE DISCOUNTS FROM A HIGHER EURO EXCHANGE RATE WOULD OFFER SUPPORT, BUT THE HIGHER EURO WILL CAUSE A SERIOUS EXPORT CRAMP. A VERY STRANGE MIX COMES TO THE EUROZONE ECONOMY.

The smart money knows that a rate hike could render great economic damage to the EuroZone. They know that just like two years ago, the feedback loop to the export trade is felt suddenly. The damage will be different in the extreme locations. A sequence of rate hikes, even if only 25 basis points each, will hit the Southern European banks that must administer tighter screws to adjustable rate mortgages. The Spanish Zombie banks are ripe for a topple and crash, and the EuroCB rate hike puts pressure on their banks directly. Regard the rate hike as a preliminary warning that the insolvency game has gone on long enough, and the lights will be turned off in the near future, not tomorrow, but soon. My focus is on the Spanish banks and the Portuguese sovereign bonds. The former are badly insolvent, banks floated along with fully permitted vast holes on their balance sheets, an exhibition of pride. The latter are wrecked and costly to continue the float, unsustainable from the 9% extreme borrowing cost, which has always preceded a breakdown. The ratcheting upward of EuroCB interest rates in my view has a hidden agenda, to break the logjam, to force the issue, to remove the impediments in the Southern Europe bank and bond systems.

The higher Euro currency is the bizarre byproduct of the ECB rate hike. The bond arbitrageurs are leveraging off the rate differential with the USTreasury Bills in order to gain some hefty futures profits. But such open windows will last only a short while. The higher Euro will cause new problems, in particular a damper on German exports, which will cost more to foreign importers. However, another angle must be considered. Germany might be attempting to cause a mini-bull rally in PIGS sovereign debt so that the big German institutions can dump massive amounts of government bonds finally. The higher Euro exchange rate offsets the lower principal bond value linked to higher bond yields. Also, one must always bear in mind that the Chinese have not likely halted their discounted purchase of PIGS bonds, as they dump USTBonds en masse. So the German motive could be to direct EuroBonds dumps with the bad markings, but the Chinese motive is indirectly to dump USTBonds in favor of those marked EuroBonds. The Chinese will demand conversion later to Gold bullion from the associated stressed broken central banks. A very complicated chess game is underway. The Chinese might be demanding a higher Euro exchange rate to be sustained during a massive USTBond dumping exercise. The German motives are the key. They want to discharge the PIGS nations pronto. They want to unplug the PIGS nation banks. They want to bring about a climax moth event for the Euro currency light fixture.

GREEK GOVT DEBT REMAINS IN CRISIS, CHRONICALLY SO DESPITE THE CHARADE OF AID LAST YEAR. NOTHING WAS FIXED, JUST PATCHWORK THAT PROVIDED BIG BANK WELFARE BAILOUTS. THE GREEK DEBT WAREHOUSE WILL BE REVISITED AS THE CRISIS RETURNS.

Europe has fixed nothing. The Euro Central Bank are accomplice the IMF has succeeded in aiding to a great extent the big European banks with considerable Greek debt exposure. But they fixed nothing. The IMF poison pill makes conditions much worse in the intermediate term, from which the nation taking the pill (austerity measures) cannot emerge. They sink into oblivion, the vast sea of unrecoverable debt. The Greek Govt debt situation has been ringing the alarm bell again. Even Gold & Silver respond in part to the morass. Clearly, the PIGS nations are in dire straits with no actual aid coming, only backhanded duplicitou banker welfare packages. Greece, Portugal, and probably Spain will soon have to leave the Euro currency community as stress reaches the limit. That is the German objective in my view. The EuroCB rate hike was in my view intended to speed up the process. Recall that Greece was supposedly resolved via bailout last May, and yet its 10-year bond has gone stubbornly higher, reaching 13.83% last Friday. Look for a renewed Euro sovereign debt panic. The safe haven is no longer the USDollar or USTBonds, neither benefiting at all from the chronic Euro debt distress. The new safe havens are Gold & Silver, and to some extent crude oil. As the sovereign debt continues to rupture in full view, the USTreasurys are more frequently regarded as a more elite but still broken equivalent to Greek Govt Bonds. One is left to ponder whether someday the USTreasury 10-year yield will shoot toward the justified 10% level. As long as the USFed has a firm grip of the Printing Pre$$, that is not likely. However, expect the USDollar to plumb new deep depths since it cannot be supported by the same monetary press.

A reliable connected German banker: „The European nations are all being pushed to the Finish ine. They all are aware that the system is defacto coming apart in a grand breakdown. The only ones refusing to accept this are the Anglos & Americans. This is a giant Goat Rodeo. The bulls are already dead and processed in the food chain. We shall eventually see a revival of a real market economy with certainty. However, before that happens, there needs to be a cleansing process, a very cruel one. All the measures we see being taken are like Intensive Care Unit measures on a terminal patient. There are a thousand ways to expire. We need to look at the very big picture to really comprehend. The universe strives for equilibrium. This means with all the negativity there is equally strong positivity. It seeks to arrive.“ A couple days later, the banker continued with more comments. The situation in Portugal was fully orchestrated, more trigger events desired to further the process. He wrote, „They are fighting for survival and it is all sinking. The revised and realigned Euro currency will happen by default. The Portugal trigger was pulled in order to stage the other events so it appears to be a logical step. DeutscheBank and the other banks will not be saved. They already received that clear message from Berlin. There are not enough resources for the DBank bottomless pit to be filled. Creditors will not get a haircut, but rather their heads will be cut off.“ Bear in mind that DeutscheBank is the connection to US & UK bankers. A savvy colleague provided his own Interpretations that add a geopolitical flavor to the events. He and the Jackass are in contact with the German banker source infrequently. He said „The EuroCB moves to strengthen the Euro currency are part of a plan to force the PIIGS and periphery countries out of the Euro in preparation for the introduction of the new partially gold-backed Nordic Euro. As the PIIGS and periphery nations sink, the losos to the German, Austrian, French, Swiss banks will escalate. DeutschBank and many other big EU banks will not be bailed out. The hidden losses are so enormous that both the shareholders as well as the senior creditors will be wiped out. The German government will save the depositors, as DBank will likely be nationalized.“ The Nordic Euro currency is scheduled for introduction in June. My belief, just mine as Jackass, not from the source, is that its time schedule could easily slide out beyond the targeted June date based on the facts and circumstances at that time. Implementation of a major currency, especially one with a gold component, is extremely difficult, complicated, and must be achieved in the face of huge banker driven political forces with potential military and terrorist threats. History is replete with precedents for the naive doubters.

Zlato a stříbro – Gold and Silver

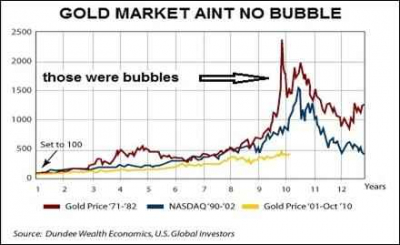

BUBBLE IN THE GOLD MARKET IS ACCUSED BY THE IGNORANT.

GOLD IS REAL MONEY. MONEY IS FLEEING PHONY MONETARY STRUCTURES. COMPARE TWO PAST VIVIDLY CLEAR ASSET BUBBLES, AGAINST WHICH THE CURRENT GOLD MARKET BEARS NO RESEMBLANCE. MAYBE WHEN GOLD REACHES $3000 OR $5000, THE ARGUMENTS WILL RING VACANT AND HOLLOW.AS LONG AS QUANTITATIVE EASING PROGRAMS ARE IN PLACE AND ACTIVELY PURSUED, GOLD & SILVER PRICES WILL SOAR. THE PROGRAMS ARE URGED BY EXPLODING BUDGET DEFICITS AND ABSENT BOND DEMAND. THAT TRANSLATES TO A RUINED USDOLLAR CURRENCY. GOLD & SILVER RESPOND TO THE DEBASEMENT AND RUIN. EFFORTS WILL BECOME RIDICULOUSLY STRETCHED TO SAVE THE USDOLLAR, BUT WILL FAIL. QE WILL GO GLOBAL AND SECRETIVE, ASSURING TREMENDOUS ADDITIONAL GAINS IN THE GOLD & SILVER PRICE. NO EFFORT TO LIQUIDATE THE BIG USBANKS WILL OCCUR, THUS ASSURING THE PROCESS WILL CONTINUE UNTIL SYSTEMIC FAILURE.

Gold & Silver will soar as long as central banks continue to expand their liquidity programs QE1 and QE2, and enlist the cooperation of other major central banks in providing artificial but coordinated USTreasury Bond demand. In the process their efforts will push the cost structure up further. In my view, since the Japan natural disaster hit with financial fallout, the Global QE is very much in effect, but not recognized as a global phenomenon

THE FINAL PUSHDOWN ON GOLD PRICE IS THREATENED, BUT IT HAS NO TEETH. IT CANNOT AND WILL N OT HAPPEN. THE GOLD CARTEL HAS BECOME IMPOTENT. THE USDOLLAR IS BROKEN, AND THE WORLD RECOGNIZES THAT FACT, EVEN IF THE AMERICAN PUBLIC DOES NOT. THE SWISS DELAYS IN GOLD BULLION DELIVERY FROM ALLOCATED ACCOUNTS HAVE REACHED THE LAWSUIT STAGE. BEWARE OF ALLOCATED ACCOUNTS HELD IN SWITZERLAND, WHICH MIGHT SOON VANISH.

An experienced gold trader who has been spot on with numerous developments in the last three years pitched in. He does not believe the Western Elite have the power, resources, tools, partners, or capability to impose their final solution. He wrote, „In all modesty, the Boyz would have to get past our desk and I cannot see that happen without those people getting thrown into the meat grinder. That does not mean that they will not try. They will get nowhere and they know it. They are facing multi-$billion law suits right now in Switzerland, where clients want to take delivery and are being given the run-around. They use all kind of legal and compliance tactics to stall, knowing well that in the end they will die a sudden death.“ This reference to the Swiss bullion bankers is a continuation of the story reported by the Hat Trick Letter last summer 2010. The Swiss have sold much of the gold bullion in Allocated segregated accounts illegally. Their delay tactics are intended to enable them time to secure Gold bullion quickly from whatever source. The Swiss are planning a nasty Force Majeure seizure of Allocated gold accounts, to replace them with depository receipts, to drag the process out, and to refuse entrance of clients into Switzerland. The Swiss banking system is almost ready to implode. A multi-$billion heist is planned.

The bet has possible shadowy overtones. Clearly somebody or some firm might actually believe the Silver market is grossly overbought, ignorant of the dynamics of inelastic demand, of COMEX shortages, of coin shortages, of growing industrial demand, of growing investment demand. Fine, let them be roadkill. But a major loss is going to be swallowed on that egg laid on the option board. Obviously, the gold cartel might have decided to invest a mere $1 million to try to wreck sentiment and send the weak hands scurrying. They misjudged the buyers and their strong hands, which includes the Chinese billionaires acting with sharpened motive. Let’s take the situation to two different extremes. Maybe the trader planned on holding the option put contracts for a longer stretch of time. Suppose some internal development is afoot that will expose the SLV fund as a gigantic fraud, whose silver bullion in inventory has been leased and even sold, leaving paper certificates in the vault. That is precisely what the Jackass and other smarter more savvy observers believe. If so, then as mentioned here before, the SLV share price would fall below the the spot silver price. A penalty to the corrupted fund would be imposed. Option contracts would still be linked to the underlying SLV share price. Suppose some global initiative development instead is afoot that will make Gold & Silver in an exalted position within a new global monetary system to be announced in early summer. The gold cartel might wish to hit the Gold & Silver price really hard beforehand, driving both down significantly. My belief is that neither extreme scenarios will unfold and blossom by July. The first scenario of exposure that SLV fund is an ugly fraud perpetrated on the investment public, that is a certainly in my view, but it will take more time. Just some speculative thinking on these two extreme scenarios.

________________________________________

Na základě souhlasu Jima Willieho budu zde pravidelně publikovat výňatky z jeho Hat Trick Reportu, jehož jsem předplatitelem. Výňatky budou publikovány formou citátů. Vybírat budu takové informace, které nejsou běžně dostupné. Formátování textu (tučné, podtržené, kurzíva, velká písmena) je původní.

Více informací na goldenjackass.com

I subscribe to Hat Trick Report and gained permission to publish extracts on my web. Formatting of text (caps lock, bold…) is same as in original report. I pick up iinformation not available on main stream media.

For more information: goldenjackass.com

Upozorňuji čtenáře, že svolení Jima Willie se týká publikování pouze na webu www.pro-investory.cz. Kopírováním obsahu z těchto stránek by se ten, kdo kopíruje názor Jima Willie bez jeho svolení, dopustil porušení ochrany autorských práv Jima Willie.