Středeční Fed

Na závěr dvoudenního jednání Fed oznámil, že přesune těžiště držených obligací více směrem ke dlouhodobým.

Fed prodá za 400 mld.USD krátkodobé obligace (splatnost do 3 let) a za stejné prostředky nakoupí obligace dlouhodobé (splatnost 6 a více let). V procentuálním vyjádření jde o přibližně 15% portfolia Fedu.

Výsledkem bude zřejmě zploštění výnosové křivky. Signalizuje tedy Fed konec „free money“ pro banky? Vypadá to tak. Sbohem, bankovní zisky.

Úrokové sazby (do 0,25%) zůstaly beze změny.

Zlato, stříbro i akcie reagovaly poklesem.

Komentáře z trhů, převzaty z https://wtaq.com/

JOSEPH TREVISANI, CHIEF MARKET ANALYST, FX SOLUTIONS, SADDLE RIVER, NEW JERSEY:

„Medium and short run this policy will have little impact on the economy and even less impact on the dollar. This is what was expected.“

JOSEPH ARSENIO, MANAGING DIRECTOR, ARSENIO CAPITAL MANAGEMENT, LARKSPUR, CALIFORNIA:

„The market is deteriorating because the Fed didn’t reduce yields on reserves. There is no additional impetus for banks to lend. It wasn’t sufficiently stimulating. The stock market is reacting to that and since that has been fairly closely coordinated with oil markets, we’re seeing declines there as well.“

STEPHEN MASSOCCA, MANAGING DIRECTOR, WEDBUSH MORGAN, SAN FRANCISCO:

„I don’t see anything of a big surprise here. The economic outlook — everyone has got a focus on this economic outlook comment and that is what has driven the market down. In terms of the actual substantive action, the 10-year (yield) is moving down because obviously you have now created $400 billion of buying here.“

CARL LARRY, DIRECTOR OF ENERGY DERIVATIVES AND RESEARCH, BLUE OCEAN BROKERAGE, NEW YORK:

„They (the Fed) is putting on the „twist“ which should be weaker dollar near term and stronger long term.

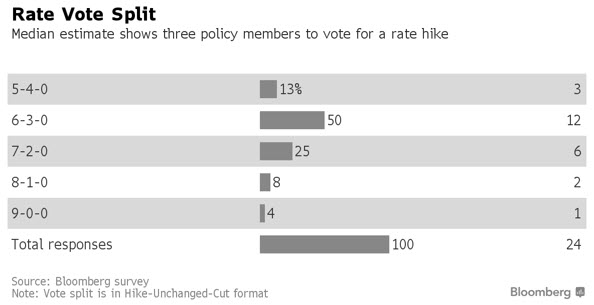

„The one thing that weighs on any decision here is that we are still seeing dissenters in the Fed. And that doesn’t bode well for a stable recovery.

„That is probably going to make crude weaker here until people get a better picture of what holds the Fed together.

MOHAMED EL-ERIAN, CO-CHIEF INVESTMENT OFFICER, PIMCO:

„The Fed has revised downwards its economic outlook and also pointed to significant downside risk. The outcome points to an even more divided FOMC.“

BRIAN DOLAN, CHIEF STRATEGIST, FOREX.COM, BEDMINSTER, NEW JERSEY:

„This is pretty much what the market was expecting, though the size is a bit more than people expected. I thought the dollar would weaken because it was as expected, but that is not happening at the moment. … I think we might see some dollar profit-taking at some point. Europe’s still a mess and the global economy right now seems to be stagnating. And this seems to be the Fed’s final shot.“

GENNADIY GOLDBERG, INTEREST RATE STRATEGIST, 4CAST, INC., NEW YORK:

„They’ve kind of hit it smack on the head. This is kind of really in the middle of where the market expectations are lying. This is what the market was expecting. The estimates were running at about $300 billion to $500 billion.

„The interest on excess reserves was a close call but they probably decided not to do it because it would cause more problems.

„This is good for Treasuries, obviously. Whether this will create economic stimulus remains to be seen. It might have kind of limited economic impact.“

Přidat komentář

Pro přidávání komentářů se musíte nejdříve přihlásit.

Zde na pitu vladních dluhopisu na burze v Chicagu dochazi po ohlaseni programu k prudkym pohybum a nahoru jdou předevsim 30-ti lety bond, ktery posiluje o 1,26% a naopak 10-ti letý vladni note jen o 0,16%. Akciove indexy jdou dolu..

Nechápu ten výprodej. Vždyť trh přeci čekal přesně tento scénář a ceny akcií v tom již byly započteny..

Tomu se rika: „buy the rumor, sell the news“…a take, Fed uz stejne moc delat nemuze, zvlaste pokud anti-business vlada dava do ekonomiky penize na projekty bez multiplikatoru…to by pri vetsich objemech penezni zasoby zpusobilo zcela urcite stagflaci..

Další komentář k dnešnímu zasedání

https://ftalphaville.ft.com/blog/2011/09/21/682626/a-few-more-analyst-reactions-to-the-fomc-statement/